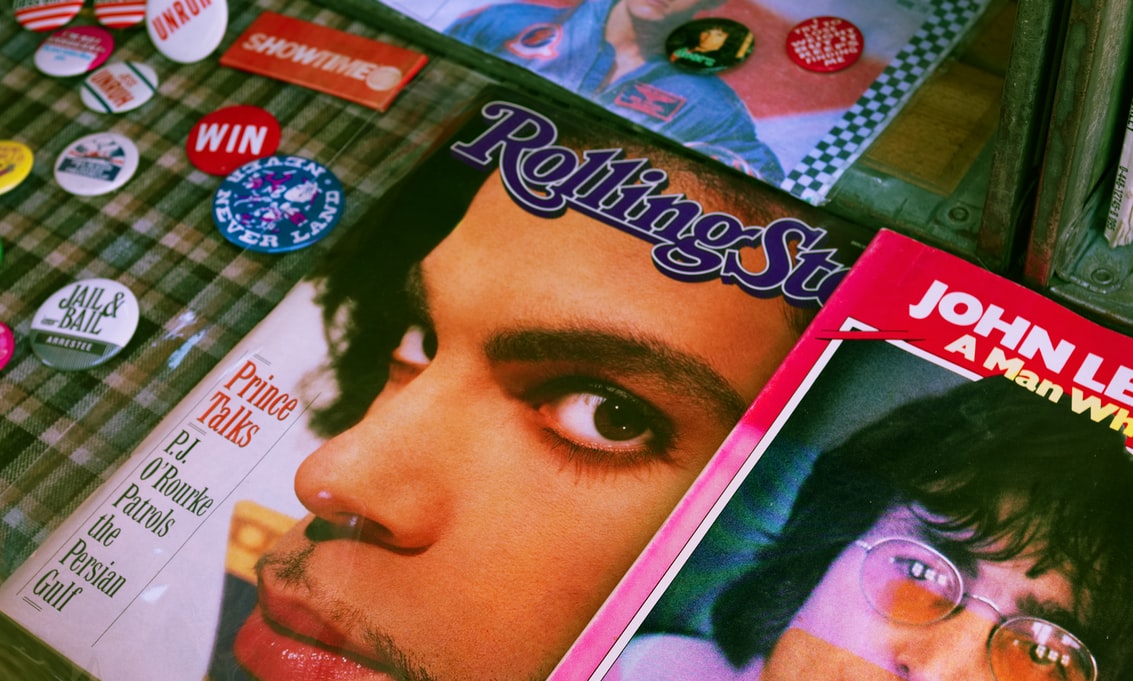

When legendary musician, singer and songwriter Prince died on April 21, 2016, he left 39 studio albums, legions of adoring and heartbroken fans and an estate valued at $200 million. But because Prince failed to ever plan for his own death or set up a will or instructions for his estate, his death also left chaos for his heirs. And it left a huge payday for the many vultures who descended on that scene of confusion and greed after his death.

Efforts to plunder his estate began soon after Prince died, when more than 45 people stepped forward to claim they were his heirs. Some hopeful heirs presented themselves as a wife or a sibling, and one Colorado prison inmate claimed to be the artist’s son, until a DNA test proved otherwise.

A judge has since reduced the list of his heirs to six people, Prince’s siblings and half-siblings. However, that process has not left the estate in a better place, as the beneficiaries of his estate continue to squabble over the spoils of Prince’s life and drag the process through the court system.

Prince’s estate, which includes master tapes of his recordings, his Minnesota mansion and studio and a 10,000-square-foot Caribbean villa, has been estimated at $200 million. But it is unclear what it will be worth after it’s been picked apart by a large group of lawyers, estate attorneys and consultants who are racking up bills daily. In the three years since Prince’s death, lawyers and administrators have spent $45 million, including $10 million in legal fees, his heirs claim in documents submitted to the probate court.

Although Prince does have rightful family heirs, it seems as if lawyers, accountants and administrators will be the primary beneficiaries of Prince’s estate. After more than three years, the estate is unsettled, and still not disbursed to the heirs. The court process, administrative and legal fees, and the infighting will continue. The process may take ten years, estate planning industry experts say.

When the “Queen of Soul” Aretha Franklin died on August 16, 2018, she also died without a will or any form of estate planning. Franklin’s $80 million estate may face many claims from fake heirs, friends that feel they are owed a piece of Franklin’s generosity, and greedy lawyers and consultants. While Franklin’s case winds its way through the courts over the next few years, her estate may be easier to clear and disburse, as it is thought that her four sons will split Franklin’s estate equally. But the process could have been far easier with a simple will, clear written instructions as to her intentions, and trusts set up so the assets could bypass the probate courts.

Unlike Prince, whose death was sudden and unforeseen due to a drug overdose, Franklin was 77 years old and knew of the pancreatic cancer that would claim her life. Even knowing the end was near, Franklin did not heed the pleadings of her attorneys to sign the estate planning documents they had prepared for her. She could not face death, so she doomed her loving family members to years of additional pain, suffering and hassle.

Many people do not want to plan for a time after their death, as most of us don’t want to think about or face our own mortality. Many folks, especially young people, fear that planning for one’s death or writing a will is bad luck and will hasten their own demise. While this is not a reasonable thought process, many intelligent people simply fail to adequately plan for the good of their estate, family and friends after they are gone.

We can ensure that our family members will face a smooth and easy estate resolution process after our death by performing four easy steps:

- Determine beneficiary designations: Who are the people that you want to receive portions of your assets? For some assets, an estate plan can designate someone to receive the property upon your death, without giving them any current ownership rights. Designating a beneficiary is available in almost all states for brokerage accounts, and in some states for real estate, motor vehicles, and other assets with title documents.

- Write a last will and testament: Even a simple will can be instructive and take away many headaches and court costs down the road. A will can designate who will receive any property that hasn’t been handled through joint ownership or a beneficiary designation. A will can also appoint someone you trust as the executor of your estate and appoint someone to be the guardian or conservator of your minor or disabled children.

- Consider Using a Living Trust: Especially if you have a large estate, or many beneficiaries, a living trust is usually the best choice for handling distribution of property, avoiding probate, and minimizing estate taxes. Property title is transferred from you to the living trust, and you become the trustee. While you are alive, you continue to control the property. Upon your death, the property is transferred to those you designate as trust beneficiaries. This transfer does not require probate.

- Designate a financial power of attorney: A financial power of attorney authorizes someone you trust to act on your behalf in financial matters after your death. A trusted person can make a big difference in ensuring your wishes and intentions are executed quickly and thoughtfully after your death. The financial power of attorney should have all the information needed to identify and locate all of your financial accounts, insurance policies, credit cards, vehicle loans, and mortgages. This person should also know where assets are physically located, and should receive instructions regarding your desires for burial, funeral ceremonies, and organ donation.

While the estate planning process can be complicated if there are many heirs and assets that are difficult to value, everyone can benefit from a few simple steps, whether the planner owns very little wealth or are blessed with many millions like Prince and Aretha Franklin. While it may be uncomfortable to face or plan for our own death, we owe it to our family members and beneficiaries to make the process as peaceful and easy as possible. The death of a family member is always tragic and sorrowful, but it is the responsibility of family leaders to not compound that sad event far into the future with a contested estate.